Budget

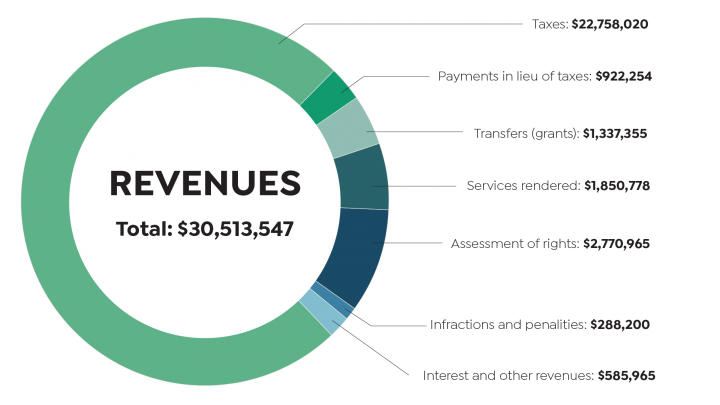

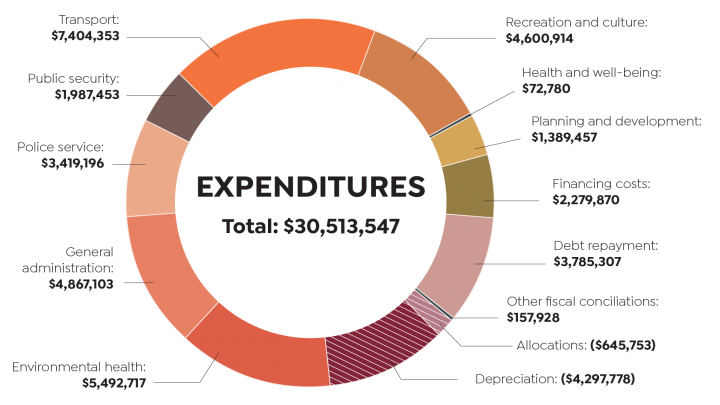

A responsible budget of $30.5M

During a special sitting held on January 13, the Municipal Council adopted its budget for the year 2026. This balanced and responsible budget of $30.5M includes a 3% increase in residential taxes, which translates into an annual increase of $123.15 for a median-value home.

Tax rate

The general property tax rate increases by 3%, reflecting efforts to maintain essential municipal services while implementing initiatives that have a positive impact on residents’ quality of life.

In addition, the rate applicable to non-residential properties is set at 3.96%, to support a fair distribution of tax contributions.

- $0.6145 to $0.6329 for residential

- $0.9968 to $1.0363 for commercial

Payement of the property taxes

The bills are payable in six instalments, which is two more than last year. The instalment dates are as follows:

- March 1st, May 1st, July 1st, August 1st, September 1st and October 1st.

Click here to consult the different payment options.

Grant for seniors to offset a municipal tax increase

A seniors grant from the provincial government is also available for those who meet the criteria. The form is mailed to potential properties that meet the criteria for the taxe increase.

Click here to access more information on this grant.

Each year, Council adopts the Municipality's annual budget for the next fiscal year at a special meeting held in mid-December.

The annual budget represents all operating expenses that provide Chelsea residents with essential services such as waste collection, snow removal, recreational activities, etc.

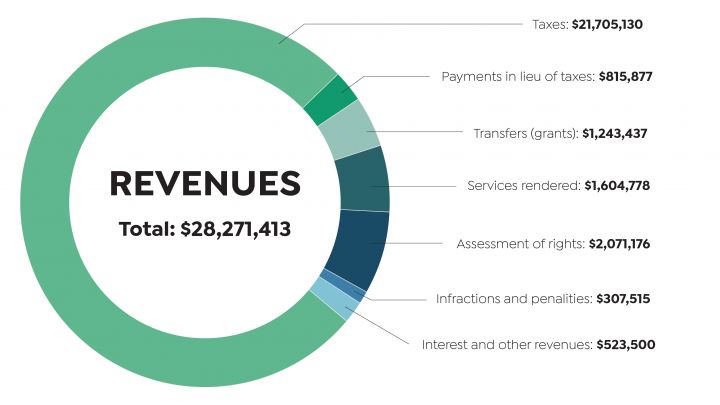

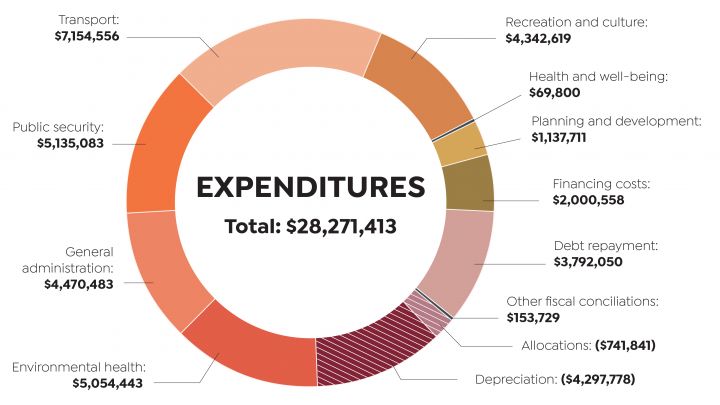

A prudent budget of $28M

Against a backdrop of tougher economic conditions that have not spared municipalities, Municipal Council has adopted a balanced budget of $28 million on December 19, 2024, with a residential tax increase of 5.85%.

Tax rate

The general property tax rate increases by 5.85%, reflecting efforts to maintain quality services while meeting the population’s priority needs.

In addition, the rate applicable to non-residential properties is set at 13.38%, to support a fair distribution of tax contributions.

- $0.5805 to $0.6145 for residential

- $0.8792 to $0.9968 for commercial

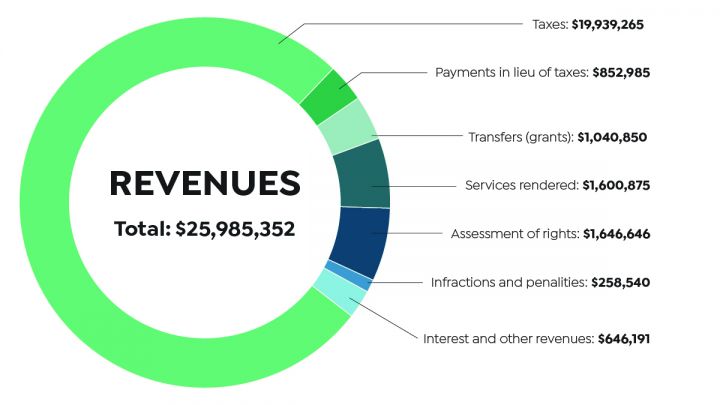

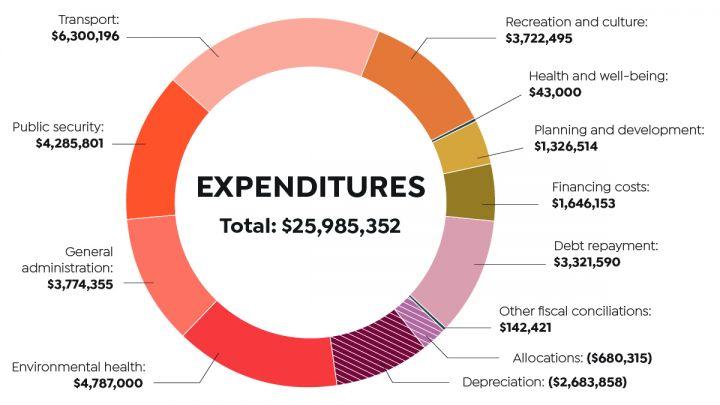

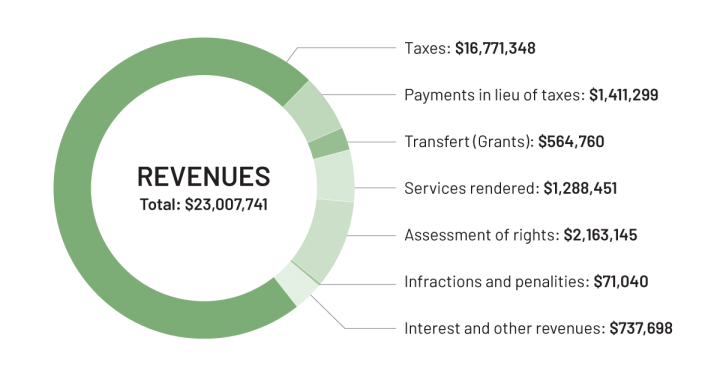

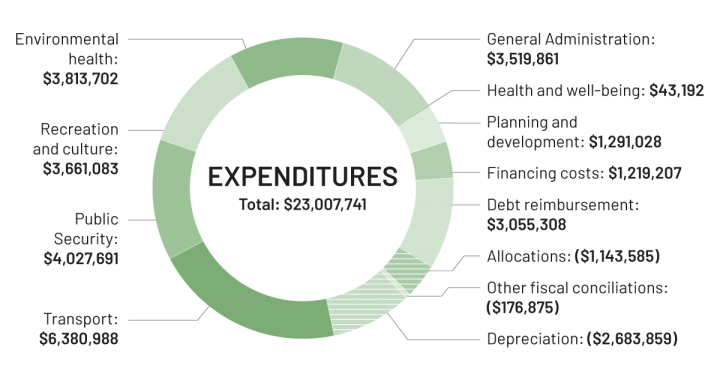

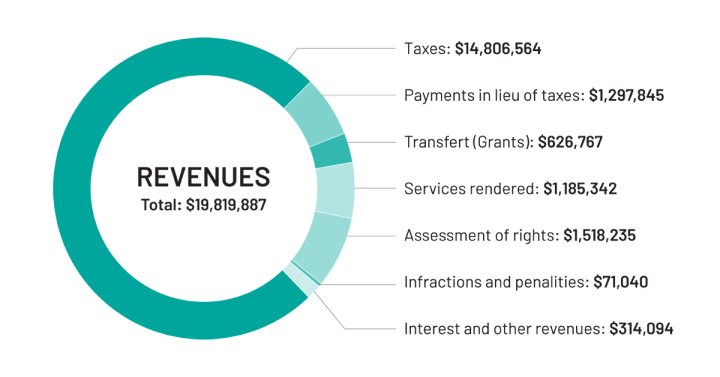

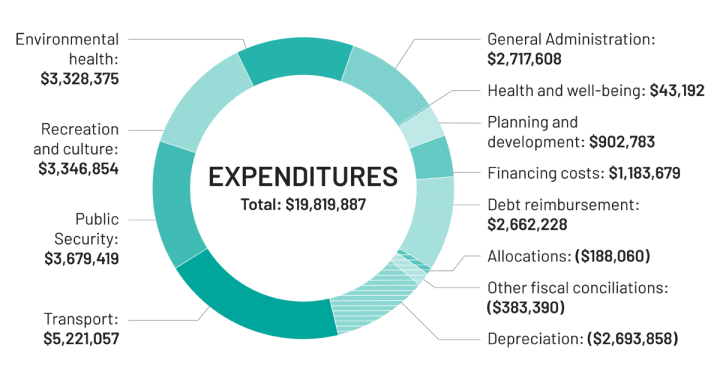

Summary of revenues and expenditures

A balanced budget of $26M

Against a backdrop of tougher economic conditions that have not spared municipalities, Municipal Council has adopted a balanced budget of $26M on December 20, 2023, with a residential tax increase of 6.3%.

Tax rate

After the tabling of the new assessment roll, which saw property values rise by a historic 46%, the Municipality cut its tax rate BY 27 % for 2024. As a result, the 2024 tax rate will change as follows compared to 2023:

- $0.7934 to $0.5805 for residential

- $1.1902 to $0.8792 for commercial

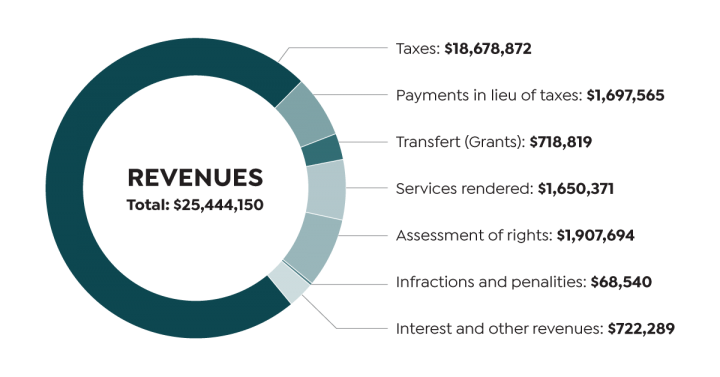

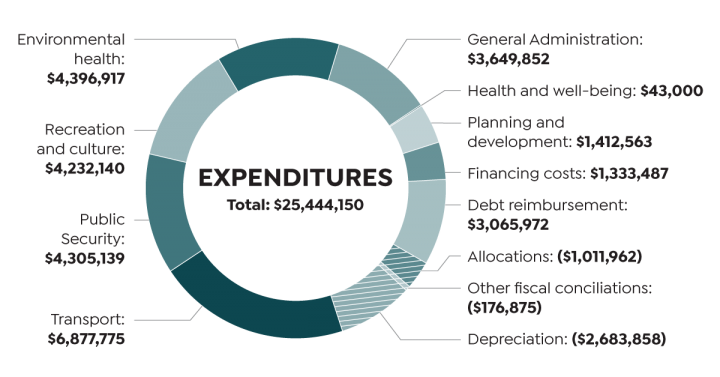

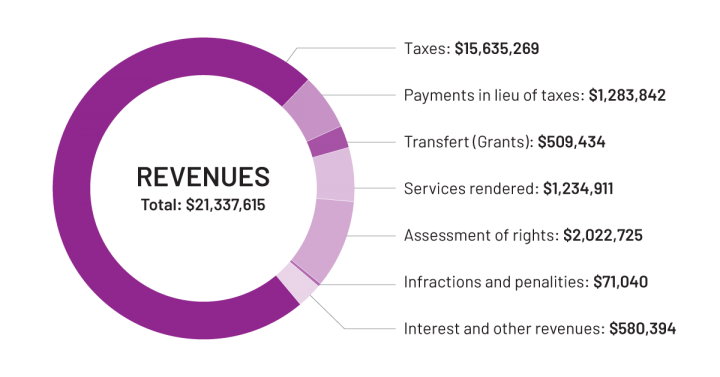

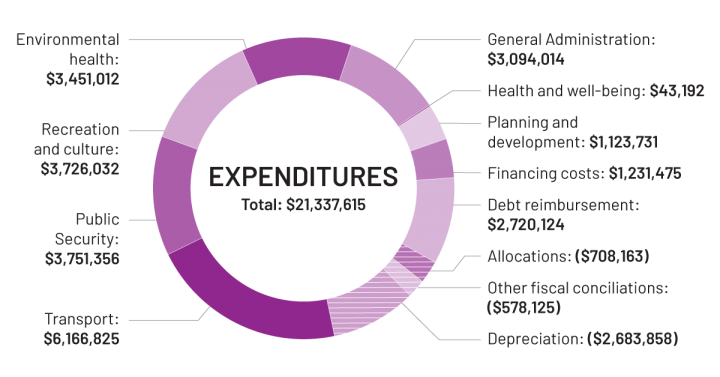

Summary of revenues and expenditures

A balanced budget of $25M

Municipal Council adopted a balanced budget of $25 million on December 20, 2022, which included a 3.4% property tax increase.

Taxe rate

3,4 % increase

- $0,7934 $ per $100 for residential

- 1,1902 $ par 100$ for non-residential

Summary of revenues and expenditures

Highlights

$227,000 for the environment and the fight against climate change

o The renewal of the Sustainable Development Action Plan

o The development of an action plan to reduce greenhouse gas emissions on the territory

o The development and adoption of a conservation plan for natural environments

o A characterization study of the heat islands on the territory

o The treatment of contaminated soils and the hydroseeding of our ditches

$450,000 in resident services

o Addition of six new positions to assist the municipal team

o Implementing an emergency response communication tool

o Maintaining annual recreational activities

$356,000 in maintenance and improvements to our infrastructure

o Continued drainage work

o Maintenance of various trails and construction of a basketball court in Sector 1

$161,000 in various projects

o Developing and adopting a Specific Planning Program for the Farm Point area

o Finalizing the cultural policy and updating the active transportation map

o Various public consultations: Teen Park Concept, Outdoor Cultural Gathering Place, Voie Verte Chelsea Interpretive Site and Hollow Glen Parks

o Continued partnership with La Fab sur Mill for cultural programming

Municipal Council adopts a budget of $23 million for the year 2022

At a special council meeting held on December 21 at 7:00 p.m., the new council unanimously adopted a realistic budget of $23 million, including a tax rate increase below the annual inflation rate.

The rates for 2022 will therefore be

- 0.7673 per $100 for residential and agricultural assessments

- 1.0841 per $100 for non-residential and industrial assessments

The tax rate increase is mainly due to the $30.2 million MRC des Collines de l'Outaouais budget adopted on November 24. The 5.18% increase in the MRC budget automatically determines the municipality’s contribution, which will increase by 11.98% for 2022. This increase alone represents 2.76% of the general tax rate for Chelsea residents.

However, it is important to mention that to limit the tax rate for residents, all sectoral rates, except septic tank emptying, will decrease in 2022, which will mean the increase in the tax bill for an average home whose assessed value has stayed the same will be less than the 2.9% announced. The fee for emptying septic tanks will increase by $20 per year.

Read the Mayor’s word (English version will be available soon)

Sound financial management

It is important for the new council to ensure sound financial management and plan smart investments, limit new expenses and allow for faster repayment of existing debts, while maintaining the flexibility to deal with exceptional situations that may arise.

Throughout the budget process, special attention was paid to compliance with the policy for managing long-term debt and accumulated surpluses. Council maintained the ratios established by the policy and ensured that investment projects limited the increase in long-term debt. In total, $613,750 will not be added to the debt in addition to the $710,000 that has been set aside for debt repayment in 2021.

In addition, an amount has been budgeted for strategic planning that will allow us to establish our needs and priorities and to have essential guidelines for good financial planning and, better internal management. Most importantly, we will be able to make informed decisions for the well-being of our citizens in the short and medium term.

Investments in environment and active transportation

Highlights

- Environmental characterization study of the banks of the Gatineau River - $18,500

- Purchase of multi-functional probes to continue studies and monitoring of the water quality of the Gatineau River and the three lakes in Chelsea - $20,000

- Road deterioration study and master plan for the Centre-Village stormwater system - $95,000

- Safety study on Route 105 at the intersection of Cross Loop and St-Clement Roads - $10,000

- Creation of a new conditional use by-law - $10,400

- Improvement of public consultations on environment and urbanism - $10,000

- Creation of a special urban planning program for the Farm Point sector - $10,000

- Re-roofing of Fire Hall #3 and the Hollow Glen Community Centre - $40,000

- Municipal garage environmental characterization study - $20,000

- Speed mitigation measure - $30,000

- Investments in the creation and maintenance of several trails

The budget also includes nearly an amount of $3.6 million (including the Quebec government portion) for debt service payments, $7.2 million for salaries and benefits and $3.9 million as a share to the MRC des Collines de l'Outaouais. The remainder of the budget is for the normal operations of the Municipality and the maintenance of services to citizens.

Three-Year Capital Plan 2022-2023-2024

The Three-Year Capital Plan (PTI) adopted in October by the previous Council includes long-term capital expenditures as opposed to the operating budget, which focuses on current year expenditures.

Since the PTI adopted by the outgoing Council is realistic for Chelsea’s current growth, the newly elected Council members chose to keep it. The PTI includes a total investment of $43 million divided into annual phases and includes the following priority projects:

- Voie Verte Chelsea Trail

- Rehabilitation of chemin de la Rivière

- Rehabilitation chemin de la Mine

The new council will be re-evaluating capital projects for 2023 and 2024 after the strategic planning exercise, which will allow them to make better long-term decisions in line with their priorities.

Municipal taxes

Chelsea residents will receive their tax bills by the end of January. This will be accompanied by a brochure explaining the budget highlights.

Payment of the four coupons is due on the following dates:

- March 1, 2022

- May 1, 2022

- July 1, 2022

- September 1, 2022

For details regarding the payment of municipal taxes, click here.

Municipal Council adopts a budget of $21.3 million for the year 2021

At a extraordinary sitting held Tuesday, December 15, Municipal Council unanimously adopted an operating budget of $21.3 million for the year 2021. This budget focuses primarily on sound financial management, the environment and active transportation.

Council also adopted a property tax freeze on the annual account for an average residence.

For 2021, the property tax rate is reduced by 6%:

- 0.7457 per $100 for the residential sector

- 1.0536 per $100 for the non-residential sector

The filing of the new three-year assessment roll 2021-2022-2023 showed an average increase in taxable assessments of 6% across all categories. As a result, Council voted in favour of an equivalent decrease in the property tax rate for both residential and non-residential properties. This is in addition to the increase in revenues generated by new developments, which results in a property tax freeze for an average residence.

Investments in environment and active transportation

Highlights

- Creation of the Fonds vert municipal, which will enable the municipality and organizations or residents to leverage municipal funding and support for environmental, sustainable development or active transportation initiatives - $150,000

- Master Plan revision - $78,000

- Creation of two active transportation trails in the center village and maintenance of the existing trails - $64,000

- Construction of an infrastructure for youth and development of a gathering place for teens - $10,000

- Community trail finalization and online public consultation for river access - $21,000

- Study on the degradation of roads and study on future needs in terms of services and infrastructure in the center village - $150,000

The budget also includes nearly $4 million allocated to debt service payments and $6.2 million in salaries and benefits. The remainder of the budget is for the normal operations of the Municipality and the maintenance of services to citizens.

Triennal Capital Expenses Program 2021-2022-2023

Municipal Council adopted its Triennial Capital Expenses Plan (TCEP) for the years 2021, 2022 and 2023 on November 3. It includes investments of $20,258,385 divided into annual phases.

Priority Projects

- Various planned community trail work ($575,000)

- Rehabilitation work on Meech Lake Road ($1.9M)

- Rehabilitation work on chemin de la Rivière ($10.3M)

Municipal taxes

Chelsea residents will receive their tax bills by the end of January. This will be accompanied by a brochure explaining the budget highlights.

Payment of the four coupons is due on the following dates:

- March 1, 2021

- May 1, 2021

- July 1, 2021

- September 1, 2021

For details regarding the payment of municipal taxes, click here.

Adoption of the operating budget for the year 2020

At a special meeting held on Tuesday, December 17, Municipal Council adopted its operating budget for 2020.

Discours de la mairesse (translation to come)

A balanced budget of $ 19.8 million

Tax increase of 3.4% caused by, among other things:

- The NCC’s valuation challenge, which creates more than $280,000 of uncertainty in PILT revenues, plus the $54 000 legal and evaluation fees to be assumed by the Municipality

- The $255,829 increase in the share paid to the MRC des Collines-de-l’Outaouais, mainly due to the unexpected increase in fees for the processing of recyclable materials and fees for adapted and public transit.

- The increase of more than 50% in snow removal contracts awarded throughout Quebec

- Preventive slope stabilization work along Chelsea Creek (75% subsidized by the Government of Quebec)

Tax rate 2020

- $0,7933 per $100 for residential evaluation

- $1,1209 per $100 for non-residential evaluation

Concretely, this means an increase of $108 for a median property valued at $415 000.

Water and sewer system cost increase inevitable

Centre-village

The cost of the water and sewer system for the centre-village this year is close to the forecasts made at the beginning of the infrastructure project. The variance from previous years is explained by the increase in operations and maintenance expenses, which vary according to the number of homes and businesses connected to the network.

Water filtration plant

- Purchase of two membrane banks to optimize production flow and reduce water losses

- Replacement of parts for dosing pumps to prevent variances when adding chemicals

- Replacement of UV lamps and probes to ensure drinking water quality

- Additional professional fees to perform vulnerability analysis as requested by

theMinistère de l’Environnement

Wastewater treatment plant

- Replacement of UV lamps to ensure compliance with environmental standards

- Replacement of lifting chains for greater worker efficiency and safety

Farm point

The increase for the Farm Point area is due to the need to empty aerated wastewater treatment tanks, a procedure carried out every seven to eight years to ensure water quality at the tank outlets.

For information

Taxation and Finance Department

This page was last updated on January 14, 2026