Taxes

Municipal tax statements are mailed by the end of January.

Please advise us of any changes of address by email at taxation@chelsea.ca .

Should you receive a statement for an immovable that you do not own, please return the bill and include the new owner's name and address.

Accounts less than $300 are payable in a single payment within 30 days of the mailing date.

Accounts equal to or greater than $300 may be paid in a single payment or by instalments, to a maximum of six equal payments:

- First instalment date: March 1st

- Other instalments dates: May 1st, July 1st, August 1st, September 1st , October 1st

IMPORTANT: Any payment not made by the due date is subject to interest charges at the annual rate of 18%. A penalty of 0.5% per full month of delay is added to a maximum of 5% per year.

Receipts will be issued for payments in person only.

You can also make your tax payment :

Online:

Through your banking institution

You may pay your taxes online through most Canadian banking institutions. Find "Chelsea taxes" in their list of clients, and use the 18-digit registration number on your tax bill as a reference (ex: 5555-55-5555-5-555-5555).

By credit card or bank transfer

You can now pay your taxes either by credit card or bank transfer via the ACCEO Transphere secure payment platform. A choice of payment methods is available.

Payment by credit card generates a service charge at the time of payment to cover the cost of processing the transaction.

* The secure payment platform also offers a choice of modalities and payment schedules.

Electronic Pre-authorized Payments:

With your authorization, we will withdraw each tax instalment from the account of your choice. Simply fill up the form and return it by mail at 100, chemin Old Chelsea or by email at taxation@chelsea.ca.

By Cheque:

Write your assessment roll number on your cheques and return along with the appropriate detachable coupon or coupons. The cheques will be credited to your account and cashed on each due date. Please allow time for mailing.

Deposit the cheque in the mailbox at the visitors' entrance of Town Hall.

In Person:

Come by the Municipal office, located at 100 Old Chelsea Road. If a coupon falls due on a day when the office is closed, you can make the payment on the next business day, without interest or penalty.

Taxes are calculated on the basis of the assessment roll as established by the MRC des Collines-de-l'Outaouais Assessment Department. The assessment roll is in effect for 2024, 2025 and 2026.

As a property owner or tenant, you may contest your property assessment within the legally prescribed time limit. Should you wish to lodge a complaint following the tabling of the assessment roll, you must do so before May 1 of the first year for which the roll applies, using a form designed for this purpose. There may be other events or circumstances that could prompt you to contest the roll. To inquire about the applicable deadlines for such complaints, please call the Municipal Tax Department at 827-6205 or contact us by email at taxation@chelsea.ca.

Certain properties are subject to local improvement taxes, in which case, the number of the appropriate borrowing by-law is shown.

Under Section 2 of the Act respecting real property duty taxes, the Province grants municipalities the authority to set rates, by regulation, for this tax bracket.

Following the adoption of by-law 1325-24, the transfer tax rate on the transfer of an immovable for the portion of the tax base exceeding $500,000 is set as follows:

- 2.25% for properties between $500,001 and $750,000;

- 3% for properties from $750,001 and more.

Properties under $500,000 are taxed according to the provincial standards established by the law concerning duties on transfers of immovables in Quebec.

Tax Calculations - New Development

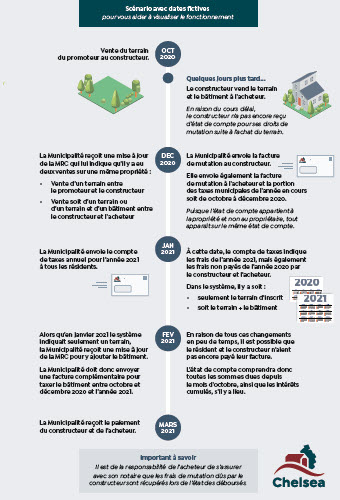

If you have just purchased a home in a new development, you may be a little confused with the different accounts payable and updates you receive in the first year.

In order to help you understand this, we have prepared a document based on a fictional scenario.

For information

Taxation and Finance Department

This page was last updated on February 19, 2026