Capital Expenditure Program

Adoption of the 2026-2030 Capital Expenditure Program

The Municipal Council adopted the Capital Expenditure Program (CapEx) for the next five years at an extraordinary meeting held on January 13th, 2026. It includes a total investment of $41.7M, divided into annual phases:

- 2026: $10.2M

- 2027: $9.3M

- 2028: $11.3M

- 2029: $4.8M

- 2030: $6.1M

Understanding municipal debt

What is municipal debt? It's a method of financing a capital expenditure. This expense is incurred to purchase, build, develop, enhance or improve a capital asset. This type of borrowing allows the cost of long-term projects to be spread over several years rather than being borne solely from annual revenues.

Explanatory document

See the official press release

Consult the complete 2026-2030 CapEx (French only)

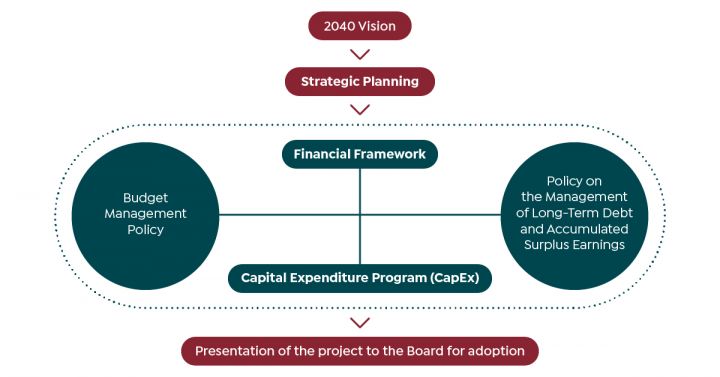

Financial Framework of the Municipality

Frequently Asked Questions

The Five-Year Capital Expenditure Plan (CapEx) represents the municipal council's investment intentions for the next five years. This document, divided into annual phases, offers a global vision of projects to anticipate financial needs. It details the purpose, amount, and method of financing the planned expenditure, which will be spread over more than 12 months. It should be noted that projects included in the CapEx are not automatically implemented; their realization depends on priorities, available resources and the results of calls for tender.

Capital expenditures enable the Municipality to maintain its assets in good condition, for example, replacing damaged roads, aging water pipes or outdated municipal buildings. They are also used to develop new projects, such as building parks, adding recreational trails or developing new infrastructures to meet the community's growing needs.

The Municipality finances CapEx projects by various means, including government subsidies and, if necessary, borrowing. If borrowing is required, it must be presented in a borrowing by-law and approved by the municipal council. This process strictly controls the amount borrowed for a specific project and its use, ensuring responsible management of public funds.

Borrowing makes it possible to finance major projects that benefit the community over several decades while avoiding imposing an excessive tax burden in the short term. This ensures balanced and equitable management of financial resources for present and future generations.

All loans must be approved by a borrowing by-law adopted by the municipal council. This by-law specifies the amounts, the projects financed and the repayment conditions. In some cases, citizens may be consulted using a register or a referendum, depending on the nature and scope of the loan.

Yes, the Municipality follows rigorous financial management principles to ensure that debt remains sustainable. Borrowing is planned based on priorities, repayment capacity, and taxpayers' impact.

The Policy on the Management of Long-Term Debt and Accumulated Surplus Earnings defines two maximum target indicators:

- Debt service ratio payable by all taxpayers

- Debt borne by all taxpayers as a function of Standardized property wealth (RFU)

These guidelines and targets guarantee prudent management that respects the Municipality's financial capacities.

Archives

Adoption of the 2025-2029 Capital Expenditure Program

The Municipal Council adopted the Capital Expenditure Program for the next five years at an extraordinary meeting held on December 16th, 2024. It includes a total investment of $54M, divided into annual phases:

- 2025: $20.2M

- 2026: $11.6M

- 2027: $14.3M

- 2028: $4.7M

- 2029: $3.2M

Adoption of the 2024-2026 Capital Expenditure Program

The Municipal Council adopted its three-year capital expenditure plan for 2024 to 2026 at an extraordinary meeting held on December 20, 2023. It includes investments of $57M, divided into annual phases:

- 2024: $24.3M

- 2025: $10.2M

- 2026: $22.4M

Adoption of the 2023-2025 Capital Expenditure Program

Municipal Council adopted its three-year capital expenditure plan (PTI) for 2023 to 2025 at an extraordinary meeting held on November 1st. The PTI includes investments of $54M allocated over three years as follows:

- 2023: $25M

- 2024: $7.5M

- 2025: $21M

PTI projects for the year 2023:

- Community access to the river

- Improvement of road infrastructures

- Safety and mitigation measures

- Voie Verte Chelsea

- Improvement of parks and green spaces

- Investments in plants

- Land acquisition and development of the territory

- Fire security

Click here to consult the complete 2023-2025 PTI (French only).

For information

Municipality of Chelsea

This page was last updated on January 14, 2026